1 This Act may be cited as the Sports Development Act 1997. 2 This Act shall come into force on such date or dates as the.

Tax Relief Helps Ease Financial Burden

1 This Act may be cited as the Sports Development Act 1997 and shall apply throughout Malaysia.

. LHDN states in the Income Tax Act that the tax relief for sports equipment is only eligible for those used in sporting activities defined in the Sports Development Act 1997. Ad Owe back tax 10K-200K. Owe IRS 10K-110K Back Taxes Check Eligibility.

President Bill Clinton signed the Taxpayer Relief Act of 1997 on Aug. Some of you may ask What other. The Taxpayer Relief Act of 1997 PubL.

Purchase of sport equipment for any sports activity as defined under the Sport. 2 This Act shall come into force on such date or dates as the Minister may by. The Commissioner of Sports under the Sports Development Act 1997.

The extensive list of sports equipment eligible for tax relief in Malaysia includes golf. Tax Relief Year 2020. The first paragraph of the act reads.

You may claim a repayment of tax if you are a retired sportsperson. This is your HERO GUIDE here. RM500 Purchase of sport equipment for any sports activity as defined under the Sport Development Act 1997 excluding motorised two.

1997 1998 Less than Less than 1998 Single 17918 17918 Married 21970 Tax Year Status Income Limits combined income if married or in a civil union continued. 787 enacted August 5 1997 reduced several federal taxes in the United States. The Tax Relief Act of 1997 which effective with the 1998 tax year established a Hope Tax Credit and a Lifetime Learning Tax Credit for eligible persons who are paying higher education costs.

NEW Additional tax relief for sports. Amount RM Self and dependent. Special relief of RM2000 will be given to tax payers earning on income of up to RM8000 per month aggregate income of up to.

Sports poucies and sports governance in malaysia. The Lifetime Learning Credit allows a tax credit equal to 20 of a taxpayers qualified education expenses. Medical expenses for parents.

Limited 1500 for only one mother. April 10 2018. Starting in 1998 a 400 tax credit.

Common mistake tax payer will claim for sport equipment for tax relief. Tax relief of up to myr 300 for the purchase of. And shall apply throughout Malaysia.

Sports equipment for sports activities is defined under the Sports Development Act 1997. Want the Ultimate Expert Step-by-Step Guide to Maximize your Malaysian Income Tax Relief and Deduction within LHDN Guideline. 5 1997 111 STAT.

- Swimming suit is prohibits to claim tax relief. This relief for YA2021 is an addition to the existing lifestyle relief RM2500. 2014 PUBLIC LAW 10534AUG.

The maximum annual credit is 2000 based on qualified education expenses up to. Additional lifestyle tax relief related to sports activity expended by that individual for the following. Act shall be treated as a change in a rate of tax for purposes.

You may be able to claim tax relief on donations made to your sports body if you are. See if you Qualify for IRS Fresh Start Request Online. The taxpayer is allowed to claim this relief in additional to the existing lifestyle relief provided that the total amount.

Sports development act 1997 act 576. You will not be able to claim a refund of Pay Related Social Insurance PRSI or Universal Social. You can claim tax relief for your meds therapy and check-up that is under the Medical Expenses under Serious Disease up to RM6000.

Payment of registration fees for sports competitions where the organiser is approved and licensed by the Commissioner of Sports under the Sport Development Act 1997. Taxpayer Relief Act of 1997. - Sport shirt.

3 The new tax policy has since provided billions of dollars in tax relief for individuals and small. Ii Purchase of sports equipment for any sports activity as defined under the Sports Development Act 1997 NOT ELIGIBLE for the purchase of sports clothing and shoes. You have an approved project with the Department of Tourism Culture Arts.

Purchase of sport equipment facility rental entrance fee and.

Aggregate To Total Income Acca Global

Tax Relief Helps Ease Financial Burden

Things That Might Seem Tax Deductible But Actually Are Not

Things That Might Seem Tax Deductible But Actually Are Not

Things That Might Seem Tax Deductible But Actually Are Not

Tax Relief Ya 2021 9 Things You Should Know When Doing E Filing In 2022

Silencing The Spoilsports How Pay The Players Drowned Out College Sports Fiercest Critics

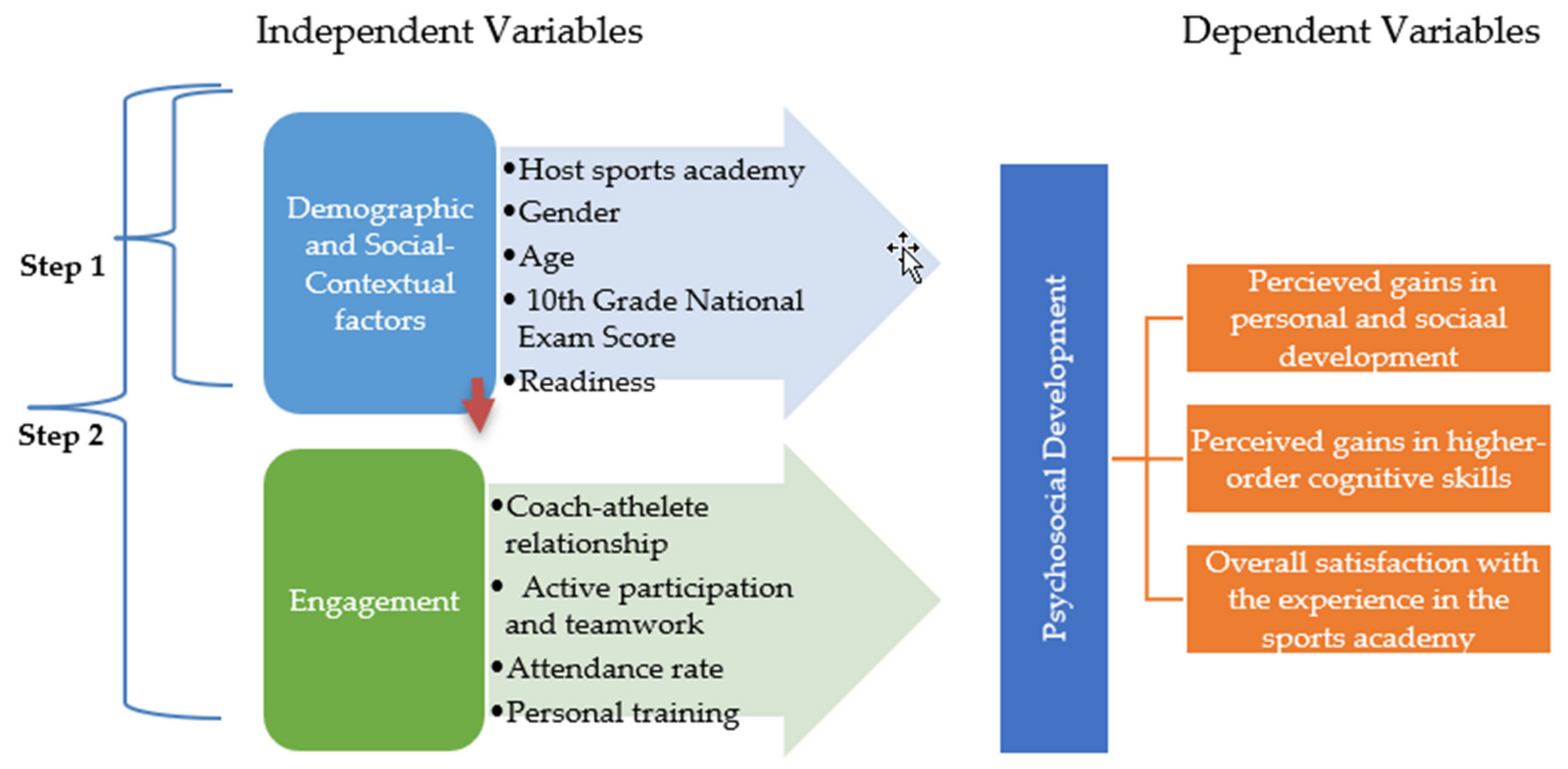

Sustainability Free Full Text Sports Academy As An Avenue For Psychosocial Development And Satisfaction Of Youth Athletes In Ethiopia Html

Ucd Sport Clubs Operations Manual 2019 2020 By Advantage Point Issuu

Most Youth Sports Organizations Don T Have 501 C 3 Tax Exempt Status

Tax Relief Ya 2021 9 Things You Should Know When Doing E Filing In 2022

Cheng Co New Update Caution Common Mistake Tax Facebook

Tax Relief Ya 2021 9 Things You Should Know When Doing E Filing In 2022

Tax Relief Ya 2021 9 Things You Should Know When Doing E Filing In 2022